The High-Earner’s Guide to the Backdoor & Mega Backdoor Roth: Eligibility, Limits, and Step-by-Step Execution

- Marcel Miu, CFA, CFP®

- Jan 15

- 8 min read

Updated: Feb 24

TL;DR

Can high earners still contribute to a Roth? Yes. If your income exceeds IRS limits for direct Roth IRA contributions, you can use the Backdoor Roth IRA (contributing to a Traditional IRA and converting to Roth) or the Mega Backdoor Roth (utilizing after-tax 401(k) contributions) to seek tax-free growth potential. The Mega Backdoor strategy allows for significantly higher contribution limits (up to $72,000+ total in 2026) but requires specific employer plan provisions.

The "Too Rich for a Roth" Fallacy

Sarah had a problem most people would kill for.

She is a Senior Director at a major tech firm in Austin. Between a salary bump and a generous RSU refresh, her Adjusted Gross Income skyrocketed. That is great news for her bank account. It was terrible news for her tax planning.

She had accepted her fate.

"I make too much money to contribute to a Roth IRA," she said. "I guess I just have to dump everything into a taxable brokerage account and deal with the tax drag."

It's a common assumption. The IRS puts strict income limits on who can contribute directly to a Roth IRA. If you make over a certain amount, the front door is locked. But Sarah was making a mistake that could potentially cost her significant tax-free growth over her career.

She wasn't actually barred from having a Roth. She was just barred from the front door.

By failing to utilize the Backdoor and Mega Backdoor strategies, she was voluntarily opting into higher potential taxes in retirement. This guide breaks down exactly how to legally bypass these income limits and optimize your tax-free wealth buckets.

What is the Difference Between a Backdoor and Mega Backdoor Roth?

How do these two strategies compare in terms of limits and complexity?

The standard Backdoor Roth uses an IRA and is limited to the annual contribution cap (e.g., $7,500 in 2026). The Mega Backdoor Roth utilizes a 401(k) plan to stash away an additional $40,000+ annually.

Think of them as two different tools for the same job.

The Backdoor Roth IRA is your precision tool. It lets you bypass income limits for the standard IRA contribution. It's available to pretty much anyone with earned income, regardless of how much you make. If you have cash sitting around and want it to grow with tax-free potential, this is your first stop.

The Mega Backdoor Roth is the heavy machinery. It utilizes the massive gap between your standard 401(k) deferrals and the absolute IRS plan maximum. But there's a catch. It requires specific plan permissions. Your 401(k) plan must allow After-Tax contributions and In-Service Distributions. If you have access to this, it's like unlocking a hidden level for your retirement savings.

How Do I Execute a Standard Backdoor Roth IRA?

What are the specific steps to funding a Backdoor Roth without triggering tax penalties?

The process involves a non-deductible contribution followed by a conversion, but timing and tax reporting are critical to avoid errors.

It sounds simple enough. You put money in one account and move it to another. But the IRS loves to make simple things complicated. If you mess up the sequence or the reporting, you could end up with a tax bill you didn't expect.

Here is the 4-Step Framework:

Contribution: Contribute post-tax dollars to a Traditional IRA. Do not take a tax deduction. This is crucial. You are putting money in that has already been taxed.

Settlement: Wait for the funds to settle. This usually takes 1-3 business days. You want to avoid "good faith violations" by moving unsettled funds. But don't wait too long. Any earnings that accrue while the money sits in the Traditional IRA will be taxable when you convert.

Conversion: Convert the entire Traditional IRA balance to a Roth IRA.

Reporting: File IRS Form 8606. This form proves the funds were already taxed so you don't get double-taxed on the distribution later.

The "Pro-Rata" Rule Trap

You cannot just convert the "new" money if you have "old" pre-tax money sitting in any Traditional, SEP, or SIMPLE IRA.

The IRS views all your IRAs as one big bucket. They don't care that you opened a new account just for this Backdoor Roth. If 90% of your total IRA money across all accounts is pre-tax, then 90% of your conversion will be taxable.

This catches people off guard all the time. They think they are converting only the ~$7,000 non-deductible contribution. But the IRS looks at their $63,000 Rollover IRA from an old job and says, "Not so fast."

The fix is usually a "Reverse Rollover." Move that old IRA money into your current employer’s 401(k) plan if allowed. This clears the deck of pre-tax IRA money and allows you to do tax-free Backdoor Roth conversions moving forward.

How Does the Mega Backdoor Roth Work?

How can I put $40k+ into a Roth 401(k) when the limit is only $24,500 (for 2026)?

You leverage "After-Tax" contributions to fill the gap between your standard deferrals and the IRS Section 415(c) limit.

Most people stop at the standard employee limit. They think that $24,500 is the most they can put into their 401(k). But the IRS actually allows a total contribution of significantly more when you factor in employer matches and other additions.

Think of your 401(k) as having three distinct buckets.

Bucket 1 is your Employee Deferral. This is your standard Pre-tax or Roth contribution, capped at $24,500 for 2026

Bucket 2 is the Employer Match. This is free money, usually capped by a percentage of your salary.

Bucket 3 is the "Mega Gap." This is the remaining space up to the total IRS limit (which is $72,000 for 2026). This is where After-Tax contributions go. But remember, this bucket is only available if your employer specifically allows for it! We have seen more and more employers offering this each year.

Am I Eligible for the Mega Backdoor Roth?

Eligibility is not determined by your income, but by your specific 401(k) plan document.

You can't just decide to do a Mega Backdoor Roth. Your employer has to offer the specific features that make it possible. It's becoming more common in tech and other high-income industries, but you have to check.

There are two mandatory plan features you need to look for.

First, After-Tax Contributions. The plan must allow you to contribute money beyond the standard pre-tax/Roth limit.

Second, In-Service Distributions (or In-Plan Roth Conversions). The plan must allow you to move that money into a Roth vehicle while you are still working there. Without this, the earnings on your after-tax money will grow tax-deferred. That is bad. You want them to grow tax-free.

Why Should I Prioritize the Mega Backdoor Over a Brokerage Account?

Is the complexity worth it compared to just investing in a taxable account?

For many, the answer is "yes". The "tax drag" on a brokerage account may significantly erode wealth over decades compared to the tax-free compounding potential of a Roth.

It's easy to default to a brokerage account. It's simple to use. There are no contribution limits. You can access the money whenever you want. But simplicity comes at a cost.

In a taxable brokerage account, you pay taxes on dividends and interest every single year. You pay capital gains taxes every time you sell a winner to rebalance your portfolio. This creates a "drag" on your returns of roughly 0.3% to 1.0% per year, depending on what you own and what tax bracket you're in.

In a Mega Backdoor Roth, you pay zero tax on dividends. Zero tax on rebalancing. And zero tax on withdrawal.

That might sound like small change, but compound that difference over 20 or 30+ years. We are talking about potentially significant additional wealth for high savers.

How Do I Access the Money? (Liquidity Rules)

Is my money locked up until I'm 59 ½ if I use these strategies?

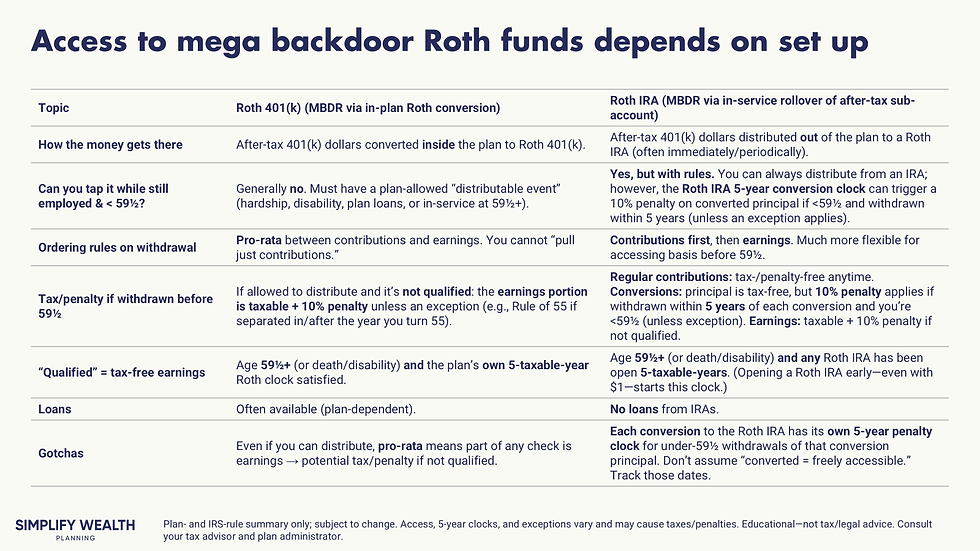

Not entirely. Roth strategies offer unique liquidity options, but the rules differ depending on whether the funds are in a Roth IRA or a Roth 401(k).

One of the biggest fears people have about retirement accounts is locking up their money. What if you want to retire early? What if you need cash for a business opportunity?

With a Roth IRA (Standard Backdoor), you generally have access to your contributions penalty-free after a 5-year aging period for each conversion. Note that I said contributions (conversion principal), not earnings.

With a Roth 401(k) (Mega Backdoor), access is more restricted while you are employed. But it usually opens up if you leave the job.

If you leave your job between age 55 and 59 ½, you might rely on the Rule of 55 to access 401(k) funds penalty-free. This is a crucial distinction from IRAs, which generally require you to wait until 59 ½ or use Rule 72(t).

See our blog post here on "Accessing Retirement Funds Before 59 ½: Rule of 55 vs 72(t) SEPP"

FAQs

Does the Mega Backdoor Roth affect my standard $24,500 401(k) limit?

No. It sits on top of that limit, utilizing a separate bucket of "after-tax" money. You can max out your pre-tax or Roth 401(k) contributions and still use the Mega Backdoor strategy.

What if my company doesn't offer the Mega Backdoor option?

You are limited to the standard Backdoor Roth IRA and taxable brokerage accounts. However, you can lobby your benefits committee to add the feature. It's becoming standard in tech and high-income industries to attract and retain talent.

Do I have to pay taxes on the conversion?

Only on the gains. If you convert your after-tax contribution immediately (which is best practice), there should be little to no gain, making the conversion virtually tax-free.

Your Next Steps

Audit your IRAs. Log into your brokerage accounts right now. Check if you have any pre-tax Traditional, Rollover, SEP, or SIMPLE IRA balances. If yes, investigate if your current 401(k) accepts "reverse rollovers" to clear the way.

Contact your 401(k) Administrator. Send them an email today. Ask two specific questions: "Does our plan allow after-tax contributions beyond the standard limit?" and "Does the plan allow for in-plan Roth conversions or in-service distributions of those funds?"

Adjust Payroll. If you are eligible, calculate how much "extra" cash flow you have available. Adjust your 401(k) contributions to spill over into the After-Tax bucket. Start filling that gap.

File Form 8606. If you executed a Backdoor Roth this year, make a note for tax time. Ensure your CPA knows about it so they file IRS Form 8606 correctly. You don't want to pay taxes twice on the same money.

Stop Letting Taxes Erode Your Wealth

Optimizing your "tax location" (choosing which account holds your wealth) is just as important as choosing the investments themselves.

The investment world is obsessed with alpha (beating the market). But for high earners, tax efficiency is often a much more controllable source of value. The Backdoor and Mega Backdoor Roth strategies are powerful tools to help shift wealth from "tax-dragged" to "tax-free."

The potential benefits are often well worth the effort.

If you need help reviewing your 401(k) plan documents or navigating the Pro-Rata rule across your various IRAs, book a strategy call. Let’s work to ensure you aren’t paying a tip to the IRS that you don't owe.

This blog is for educational purposes only and should not be taken as individual advice

Simplify Wealth Planning

Fast-Tracking Work Optional For Employees Earning Company Stock | Turn Your Stock Comp Into Wealth, Cut Taxes & Live Life Your Way | Flat Fees Starting at $6,500

Marcel Miu, CFA and CFP® is the Founder and Lead Wealth Planner at Simplify Wealth Planning. Simplify Wealth Planning is dedicated to helping employees earning company stock master their money and achieve their financial goals.

Disclosures

Simplify Wealth Planning, LLC (“SWP”) is a registered investment adviser in Texas and in other jurisdictions where exempt; registration does not imply a certain level of skill or training.

If this blog refers to any client scenario, case study, projection or other illustrative figure: such examples are hypothetical and based on composite client situations. Results are for informational purposes only, are not guarantees of future outcomes, and rely on assumptions specific to the scenario (e.g., age, time horizon, tax rate, portfolio allocation). Full methodology, risks and limitations are available upon request.

Past performance is not indicative of future results. This message should not be construed as individualized investment, tax or legal advice, and all information is provided “as-is,” without warranty.

The material and discussions are for informational purposes only. These do not constitute investment advice and is not intended as an endorsement for any specific investment.

The information presented in this blog is the opinion of Simplify Wealth Planning and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but no liability is accepted for any inaccuracies.

We recommend consulting with your independent legal, tax, and financial advisors before making any decisions based on the information from this blog or any of the resources we provide here-within (models, etc).