How to Prepare for and Maximize Your Company’s Upcoming IPO: The Tech Employee’s Liquidity Roadmap

- Marcel Miu, CFA, CFP®

- 8 minutes ago

- 11 min read

TL;DR

An IPO converts your paper wealth into liquid assets, but it also triggers complex tax events such as the "double-trigger" RSU vesting bomb and the AMT calculation for ISOs. Without a plan, taxes can eat up to 50% of your windfall. To work toward optimizing your windfall, you have to plan before the SEC S-1 filing by reviewing the details, projecting your tax withholding gap, and managing the six-month lock-up period. This guide covers the general timeline and tax strategies to help protect your wealth.

The “Million Dollar” Surprise - Why "Wait and See" Can Be a Costly Mistake

Liam was an early engineer at a unicorn startup. He joined when the team fit in a single conference room. He took a lower salary in exchange for a large equity stake because he believed in the mission.

For six years, he coded late into the night and watched the company grow from a scrappy underdog to a market leader. He had tens of thousands of Incentive Stock Options and a pile of Restricted Stock Units that he viewed as his path to freedom. When the IPO rumors started swirling around the office water cooler, Liam did exactly what most people do: he did nothing. He assumed the finance department or the company lawyers would tell him what to do when the time came.

A few months later, the opening bell rang and confetti fell. The stock price popped on day one, and Liam felt amazing.

Then reality hit him hard because he had not exercised his ISOs yet, so he missed starting the capital gains clock. He ignored the new Employee Stock Purchase Plan (ESPP) because he didn't have time to learn about it. While his RSUs finally vested, he also got hit with a fifty-thousand-dollar surprise tax bill in April. The company withheld taxes at the standard 22% rate, but Liam was in a much higher tax bracket. He was forced to sell shares at less favorable pricing just to pay the IRS. Liam went from feeling wealthy to scrambling for cash. This guide is designed to help you avoid becoming Liam.

We are moving you from a passive participant to an active strategist in your own liquidity event.

Understanding the Timeline - When Should I Start Planning for the IPO?

Most people think an IPO is a single-day event. They think about the bell ringing and the party, but that is the wrong way to look at it. An IPO is a 6 to 12+ month event. Your ability to manage taxes often decreases the closer you get to the public listing. If you wait until the company files the S-1 registration statement with the SEC, you may have waited too long to make the most impactful moves.

You need to fully understand the visual above.

Before the filing, you can exercise stock options to start the clock on long-term capital gains. This lower tax rate can potentially save you 20%+ on your tax bill compared to ordinary income rates. But once the S-1 is filed, the company usually enters a quiet period (meaning you can't do much).

This is why the 12 months before the filing, when rumors start swirling, are the critical window for financial planning.

Managing Restricted Stock Units - Will My RSUs Trigger a Significant Tax Event on Day One?

Restricted Stock Units are the most common form of equity compensation in late-stage tech companies. They seem simple: you get the shares, and then you can sell them. But in a private company, they usually have a "double-trigger" vesting schedule. You need to understand this to avoid a significant tax pile-up.

The two triggers are usually service and liquidity.

The service trigger is your time at the company. For example, you vest 25% after one year and then monthly after that. Most employees satisfy this trigger just by showing up to work.

The second trigger is the liquidity event, which in this example is the IPO. The problem is that the liquidity trigger happens for everyone at the same time.

Imagine you've been at the company for four years. You've accumulated thousands of vested RSUs. But for tax purposes, you don't own them yet because the liquidity condition wasn't met. On the day of the IPO or shortly after the lock-up release, that condition is met. Every single RSU you earned over the last four years vests on the same day. This bundles a large amount of "income" into a single tax year. Your taxable income shoots through the roof.

You lose control over the timing as the income happens whether you want it to or not. You need to know this is coming, so you don't spend that money before the tax bill is settled.

The Withholding Trap - Why Do I Owe the IRS If Taxes Were Withheld?

This is the specific mechanic that hurts tech professionals the most. It's the "supplemental tax rate" withholding trap. When your company releases your RSUs, it is required by law to withhold taxes. They usually withhold 22% for federal taxes on supplemental income under one million dollars.

Here's the math problem: the IPO and the vesting of all those RSUs will likely push your total income into a much higher tax bracket than you're used to. It may even put you in the top federal tax bracket of 37%. The company withholds 22%. You owe 37%. There is a 15% gap.

If you have $500,000 worth of RSUs vesting, the company might withhold $110,000. But you actually owe $185,000. You're short $75,000. You'll likely have to write a check to the IRS for that amount by April 15th of the following year. If you spent all the cash from the RSU sale or if you held the shares and the stock price dropped, you still owe that tax based on the value at vest. This is how people can face liquidity issues. You must calculate this gap immediately and set that cash aside in a safe, liquid account, and even consider making an estimated tax payment directly to the IRS.

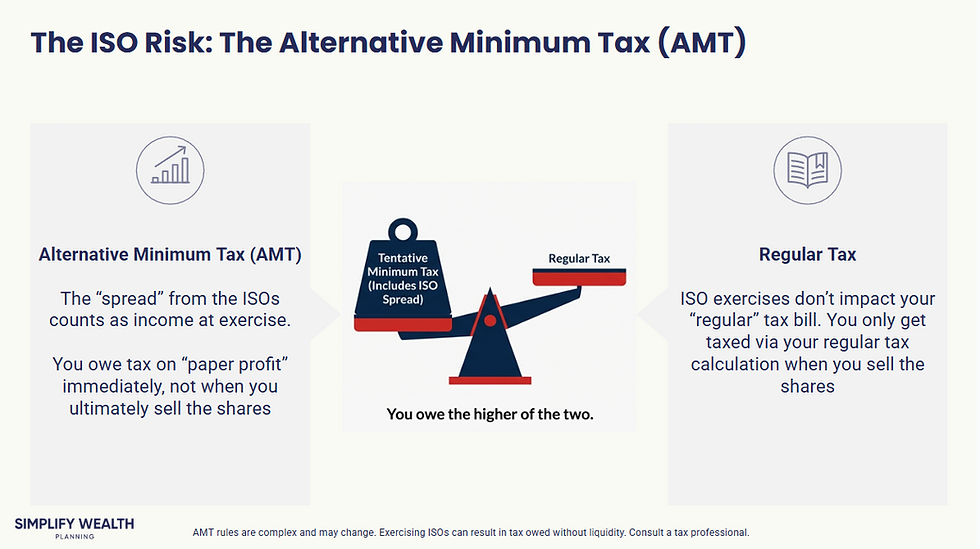

Incentive Stock Options (ISOs) - How Do I Manage the AMT "Paper Profit" Risk?

Incentive Stock Options are the "gold standard" of startup equity. They offer the potential for tax-deferred growth and preferential tax rates (long-term capital gains taxes).

If you follow the rules, you generally do not pay regular income tax when you exercise. You only pay long-term capital gains tax when you sell (if holding periods are met).

But there is a catch.

It's called the Alternative Minimum Tax (AMT).

Phantom Income

When you exercise an ISO, you pay the strike price to buy the share. The difference between your strike price and the current fair market value is called the "spread."

For regular tax purposes, this spread is not income.

But for the AMT calculation, that spread is considered income.

It's "phantom income" because you have not sold the stock yet. You don't have the cash. But the IRS still counts it.

If you exercise a large block of ISOs when the spread is wide, you can trigger the AMT. You might owe tens of thousands of dollars in taxes on a stock you still hold.

If the stock price crashes later, you still have to pay that tax. This scares people away from exercising. Or worse, it catches them by surprise and leaves them scrambling to come up with the cash to make the tax payment.

The "Crossover" Strategy

However, you don't have to exercise all of your ISOs at once.

One prudent strategy is to find your ISO AMT crossover point. This is the specific number of options you can exercise that fills up your AMT exemption bucket without spilling over into actual tax liability.

It is often considered a tax-efficient exercise strategy. You exercise ISOs to start the clock on long-term capital gains, but without triggering the extra tax bill.

For a deeper dive on ISO mechanics, read our guide ISO vs. NSO: Maximizing Value While Minimizing Tax.

Non-Qualified Stock Options (NSOs) - Should I Exercise NSOs Before or After the IPO?

Non-Qualified Stock Options are different than ISOs. They don't have the special tax preference that ISOs have. When you exercise an NSO, the spread is taxed immediately as ordinary income. It's just like receiving a cash bonus, but you get stock instead.

Because there's no special tax advantage to holding the stock after exercise, it's often not beneficial to use your own cash to exercise NSOs before the IPO. You're putting your own money at risk for a limited tax benefit. The better approach for many employees is to wait until the IPO and do a "cashless exercise."

A cashless exercise is simple. You tell the broker to exercise your options and immediately sell enough shares to cover the strike price and the taxes. You end up with the net shares or the net cash.

You never have to touch your savings account.

This removes some risk of buying stock that might drop in value. The only time you might want to exercise NSOs early is if the strike price is extremely low and you want to start the capital gains clock, but you have to be willing to pay the tax bill out of pocket today.

The ESPP Opportunity - Is the Employee Stock Purchase Plan Worth It?

The Employee Stock Purchase Plan (ESPP) is often the most overlooked part of an IPO strategy. It's standard to see the ESPP launched as part of the going public process, and it's designed to be an employee benefit.

Most people ignore it because they are focused on their options and RSUs, but this is a mistake. If your ESPP includes a "lookback provision", which is common, this can make the plan a powerful wealth-building lever.

Why This Matters at an IPO

The important language is often buried in the S-1 filing.

What you want to search for is whether the ESPP "offering period" uses the share price before the IPO pop. This matters since the IPO price often appears to be set artificially low to encourage a Day 1 "pop."

When the ESPP offering period ends 6 months later (the typical ESPP window), the public stock price is often much higher.

The Math of the Lookback

This is sample math, but the terms shown here are pretty common across ESPP plans.

Hypothetically, let's look at the numbers:

IPO Price (Offering Date): $10

Current Public Price (Purchase Date): $40

Discount: 15%

The plan applies the 15% discount to the lower price ($10). You buy the stock for $8.50. The stock is worth $40.

You are instantly up over 300%.

There's no guarantee the stock goes up, so you will have to evaluate your ESPP on a case-by-case basis, but this is the general gist of how to think about it.

Many employees find it beneficial to maximize their ESPP contribution during an IPO year if this lookback provision exists. Even if it doesn't, knowing how you want to approach your ESPP should still be part of your strategy.

Recapping Your IPO Liquidity Strategy

We covered a lot of ground. The transition from private employee to public shareholder is complex.

The 6-12+ months leading up to the IPO is your critical planning window. If you sit on your hands, your strategic options may decrease.

Here is your cheat sheet:

Timeline: The IPO isn't a single day. It is a 6-12+ month cycle. Pre-IPO is for tax planning (exercising). Post-IPO is for liquidity (selling).

Cash Flow: Cash is your lifeline. You must prepare liquid cash for the potential "supplemental tax gap" on your double-trigger RSUs. Calculate the potential 37% liability vs. the 22% withholding and save the difference.

ISO Precision: Run an AMT projection before you exercise early.

The ESPP Lever: Don't ignore the ESPP. If a lookback provision exists across the IPO date, it can be a powerful tool for generating wealth.

FAQs

Q: What is the IPO Lock-Up Period?

It's a contractual restriction that usually lasts 180 days. It prevents insiders and employees from selling shares immediately after the IPO. This is designed to stabilize the stock price so the market does not get flooded with sell orders on day one. You're often unable to act during this time.

Q: Should I use a 10b5-1 plan?

10b5-1 plans are automated trading plans often used by executives, but they can be useful for senior employees, too. You set a schedule to sell shares automatically once the lock-up expires. It removes emotion from the decision. You decide today that you will sell a set percentage of your holdings every month, regardless of the price. This is a great way to enforce discipline.

Q: What is the difference between a Direct Listing and an IPO?

A direct listing is when a company lists on the exchange without raising new capital. The big difference for employees is that there is often no lock-up period. You can usually sell your shares on the first day of trading. This provides immediate liquidity but can also lead to more volatility.

Your Next Steps - The IPO Readiness Checklist

You need to take action now. Reading this blog is step one. Step two is getting your financial house in order.

1. Inventory Your Grants. Log in to Carta, Shareworks, or whatever portal your company uses. Distinguish between your ISOs, NSOs, and RSUs. Write down the grant dates and the expiration dates. You need a clear picture of what you own.

2. Calculate the Gap. Estimate your RSU value at the expected IPO price. Calculate up to 37% of that total. Subtract the 22% your company will withhold. That number is the cash you should consider setting aside.

3. Check for QSBS. If you exercised options years ago when the company was small (gross assets under $50M), your gains might be federally tax-free under Section 1202. This could potentially save you millions. Dig up your old exercise paperwork and read our deep dive here: Do My Startup Shares Qualify for 0% Capital Gains Tax Under Qualified Small Business Stock (QSBS) Law?

4. Define Your Liquidity Number. Determine how much cash you need for your life goals. Do you want to buy a house or pay off student debt? Set a sell target that hits those goals. If the stock hits that price, execute the plan.

Don't Let the IPO Celebration Become a Tax Headache

The transition from private to public is a life-changing event. You worked hard for those shares. You dealt with the late nights, the stress, and the uncertainty of startup life. But taxes are a reality. The difference between optimizing your hard-earned equity and losing a large portion to taxes and poor timing comes down to the plan you build today.

You don't have to do this alone.

Need to model your specific IPO strategy? Book a consultation with us. We specialize in helping tech professionals navigate the complex intersection of AMT, RSU withholding, and IPO liquidity planning. We can build a custom timeline that helps you take control of your wealth.

This blog is for educational purposes only and should not be taken as individual advice

Simplify Wealth Planning

Fast-Tracking Work Optional For Tech Pros | Turn Your Stock Comp Into Wealth, Cut Taxes & Live Life Your Way | Flat Fees Starting at $3k - Not Based On How Much Money You Have

Marcel Miu, CFA and CFP® is the Founder and Lead Wealth Planner at Simplify Wealth Planning. Simplify Wealth Planning is dedicated to helping tech professionals master their money and achieve their financial goals.

Disclosures

Simplify Wealth Planning, LLC (“SWP”) is a registered investment adviser in Texas and in other jurisdictions where exempt; registration does not imply a certain level of skill or training.

If this blog refers to any client scenario, case study, projection or other illustrative figure: such examples are hypothetical and based on composite client situations. Results are for informational purposes only, are not guarantees of future outcomes, and rely on assumptions specific to the scenario (e.g., age, time horizon, tax rate, portfolio allocation). Full methodology, risks and limitations are available upon request.

Past performance is not indicative of future results. This message should not be construed as individualized investment, tax or legal advice, and all information is provided “as-is,” without warranty.

The material and discussions are for informational purposes only. These do not constitute investment advice and is not intended as an endorsement for any specific investment.

The information presented in this blog is the opinion of Simplify Wealth Planning and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but no liability is accepted for any inaccuracies.

We recommend consulting with your independent legal, tax, and financial advisors before making any decisions based on the information from this blog or any of the resources we provide here within (models, etc).